Risk & Credit

Green light great customers, protect the book.

Faster decisions, evidence in seconds – explainable, approved, and continuously watched in production.

Expand approvals without compromising risk tolerance: champions picked by performance, decisions logged with lineage, and every change governed by maker–checker and live risk controls.

18

banks and insurers live

140

Use Cases

Measurable Business Impact

What moves when underwriting moves

+32%

approvals at the same loss appetite

Same day vs. multi-day approvals

90%

faster to production vs. code‑plus‑consultants

The Manual Control Problem

Conversion suffers when controls are manual. Losses rise when controls are blind.

Manual reviews, scattered evidence, and black‑box models force a false choice between growth and governance; governed Auto ML closes the gap so approval rates climb while committee‑grade documentation and portfolio checks remain automatic.

From data to defended decisions - without a rewrite.

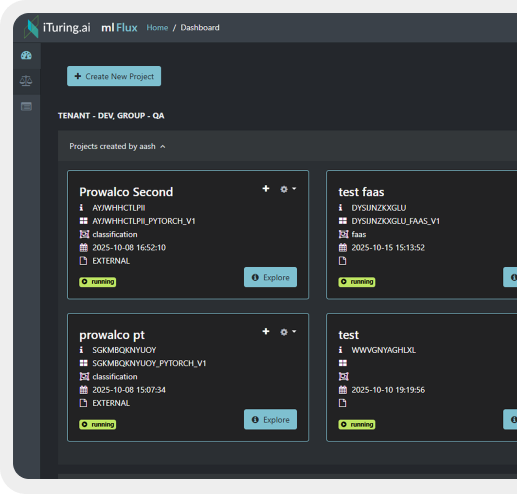

Data in

Bureau, applications, transactions, statements, and alt‑signals assembled via feature store with 25,000 ready financial features and full lineage for safe reuse (batch or stream).

Models

4,000 agents compete to select a champion. Explainability and documentation log at every step and challengers continue learning for controlled lift.

Deploy and Monitor

Any framework (Python, R, Spark, SAS) with maker–checker and version control; blue/green endpoints; 60+ live‑risk checks trigger auto‑retrain guidance or instant rollback.

Manual vs Automated

Built for MRM, audit, and board read‑throughs.

Immutable lineage and per‑decision explanations - why approved, why declined, which variables mattered, time‑stamped.

Maker–checker approvals, centralized model inventory, and complete change history for every release.

One‑click evidence reports for auditors and committees, aligned to control policies and retention rules.

Three moves that raise approvals without raising losses.

Thin‑file underwriting

Augment sparse files with governed features and alt‑signals to recover overlooked good risk.

Second‑look queue

Champion in production, challenger in the wings; route edge cases to policy‑bound review to capture safe lift.

Price‑to‑approve

Pair approval propensity with elasticity so margin, not volume, dictates the extra yes.

Drop‑in for LOS, decision engines, and your data estate.

Connect LOS and decision engines, core banking and bureaus, CRM and servicing, plus lakes and streams; expose low‑latency scoring via versioned APIs or SDKs.

Real‑time endpoints with blue/green swaps.

Event‑driven updates with auto‑retrain recommendations.

Role‑based dashboards for business, risk, and MRM.

Aligned incentives, shared evidence.

Head of Credit

Higher win rates at constant risk.

Model Risk Lead

Faster approvals, complete evidence, simpler exams.

Underwriting Ops

Fewer escalations, clearer reasons, faster SLA.

Data/IT

Any‑framework deploy, monitored, reversible, and observable.

Learn and launch without the six month detour.

Frequently Asked Questions

What data is required and in what cadence?

Application, bureau, and transactional feeds; batch or streaming with feature‑store lineage for governed reuse across models.

How are models documented and approved?

Explainability and documentation log per step; maker–checker and model inventory centralize sign‑offs and audits.

Can we govern non‑iTuring models?

Yes – Python, Spark, and SAS models governed with the same approvals, versioning, and evidence packs.

Time to first value?

First wins in 2–4 weeks; portfolio‑level documentation within 30–60 days depending on scope and data access.