INTEGRATED AI FOR REGULATED INDUSTRIES

Predict. Personalize. Act. Govern.

One platform that closes the loop – predictive models, GenAI, and autonomous agents with compliance native to every layer. iTuring turns business intelligence into business outcomes.

18

banks and insurers live

140

use cases

The False Tradeoff

Fragmented AI

or integrated intelligence?

Most enterprises inherit the “best-of-breed becomes worst-of-integration” trap. Predictive models don’t talk to personalization engines. GenAI can’t trigger autonomous actions. Agents operate without governance. The result: insights trapped at the insight stage, context siloed across vendors, and compliance retrofitted after deployment when audit finds the gaps.

iTuring eliminates that architecture tax. Predictive, generative, and agentic AI operate on one data foundation with governance engineered into every layer – not bolted on. Models feed agents. Agents personalize customer outreach. Outcomes retrain predictions. Immutable audit trails throughout.

Most enterprises inherit the “best-of-breed becomes worst-of-integration” trap. Predictive models don’t talk to personalization engines. GenAI can’t trigger autonomous actions. Agents operate without governance. The result: insights trapped at the insight stage, context siloed across vendors, and compliance retrofitted after deployment when audit finds the gaps.

iTuring eliminates that architecture tax. Predictive, generative, and agentic AI operate on one data foundation with governance engineered into every layer – not bolted on. Models feed agents. Agents personalize customer outreach. Outcomes retrain predictions. Immutable audit trails throughout.

Three things traditional platforms can’t deliver.

One Platform, Complete Intelligence Stack.

One Platform, Complete Intelligence Stack.

Deploy predictive models, generative AI, and autonomous agents without integration middleware. Shared data foundation. Unified observability. No vendor sprawl.

Context flows across layers – predictions inform personalization, agents execute strategies, outcomes improve models. All on one governed backbone.

Production‑Grade

from Day One.

Production‑Grade from Day One.

No pilot purgatory and no “works in dev, fails in prod” disasters – champion models selected by performance with governed change control.

Built for regulated industries where every model faces an auditor and every decision requires a witness. Approvals that stand up in audit, not bolted-on documentation.

Autonomous Improvement,

Not Manual Retraining.

Autonomous Improvement, Not Manual Retraining.

Agents don’t just execute – they close the learning loop. Collections strategies adapt to portfolio behavior. Fraud models evolve with attack patterns. No data science bottlenecks.

Your AI gets smarter over time because outcomes feed back into intelligence. Continuous learning without continuous redeployment.

Results regulators respect, outcomes CFOs measure.

Business Outcomes by Use Case

+32%

approvals

Risk appetite maintained.

Regional Bank, $18B assets – Credit Risk

92%

fraud accuracy

fewer false positives.

FinTech platform, 2M users – Financial Crime

20%+

collections lift

lower cost to recover.

National insurer – Collections & Recovery

$45M

in 90 days

net new deposits.

Credit union, 500K members – Growth & Retention

Platform Superiority

50,000

features

full lineage,

zero code.

Data Accelerator – financial signals ready‑to‑use

90%

faster

weeks to production at scale.

Universal workflows – governed from the start

30‑minute

investigations

direct root cause visibility.

Model Risk – bias and drift controls

Any model,

governed

Python, SAS, third‑party.

Model Ops – one click, full accountability

Five powers, one platform, complete governance.

From siloed data to production decisions - every stage auditable, every model accountable, every deployment governed.

CONNECT

iTuring Data Accelerator

Unite siloed data with 200+ connectors, drag-and-drop to build 50,000+ ML-ready features, deploy via API with complete lineage.

BUILD

iTuring AutoAI

4,000 AI agents compete to find champions with audit‑grade explainability and auto‑documentation delivering business‑ready models in weeks.

DEPLOY

iTuring Model Ops

Any framework, any model, production‑ready in seconds with maker‑checker approvals and one‑click rollbacks.

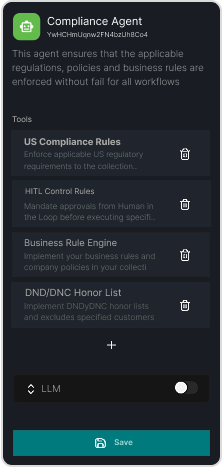

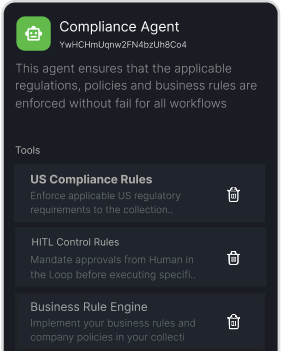

PROTECT

iTuring Model Risk

Continuous monitoring across 60+ parameters with root‑cause answers in 30 minutes, not 3 weeks.

GOVERN

iTuring Model Governance

Centralized inventory, approvals, and immutable audit trails – regulatory examination tomorrow, full documentation today.

Intelligence that thinks, personalizes, and acts.

A customer misses a payment. iTuring’s predictive layer scores default risk and payment propensity. The generative layer crafts a personalized message based on behavioral fingerprints – not a generic template. An autonomous agent selects the optimal channel, timing, and offer.

When the customer pays, that outcome retrains the model for the next interaction.

That’s integrated AI. No handoffs between systems. No compliance gaps. No manual orchestration.

Deploy this across collections, fraud detection, underwriting, and retention – all in one platform with lineage tracking and maker-checker approvals built in.

iTuring Collections Agent

Predict default risk, personalize outreach, and prevent voluntary non‑payment achieving over

20%+

Lift

60%+

Low Cost

10x

ROI

Marketing Agent

Net new money with price optimization

Coming Soon 2026

Underwriting Agent

Automated exception handling with audit trails

Coming Soon 2026

Who We Build For

Built for leaders in regulated industries.

Banks & Credit Unions

Same‑day underwriting, lower fraud false positives, higher recovery rates, and true net new money growth – governance built in for audit‑ready operations.

Insurance

Sharper risk selection, SIU triage in minutes, faster claims decisions, and higher retention – with explainability and approvals at every step.

FinTech

Faster originations, real‑time payments risk, stronger collections, and scalable growth – with lineage, compliance, and live risk checks embedded.

Recognized by industry leaders

Trusted by regulated institutions

See governance at work, not on slides.

In 15 minutes, walk through lineage, approvals, and traceability on a live flow for risk, fraud, collections, or growth – no decks, no pitch.

18

banks and insurers live

140

use case solutions