Insurance AI that stops revenue leakage, sharpens risk, and clears audit

Governed intelligence for claims, fraud/SIU, underwriting, and retention – live in weeks

Add explainability, lineage, approvals, and live risk checks into every decision so adjusters and underwriters move faster without sacrificing scrutiny or control.

18

banks and insurers live

140

use cases

Built from the ground up for your business

Property & Casualty

Triage FNOL (First Notice of Loss) in minutes, surface subrogation early, and reduce indemnity/LAE with explainable severity and routing models.

Life & Annuity

Improve risk selection and lapse prevention with maker–checker approvals and exam‑ready documentation across products and riders.

Health

Lower false positives in fraud/waste/abuse and accelerate SIU (Special Investigations Unit) handoffs with lineage‑aware case building and drift monitoring.

Reinsurance/MGA

Standardize governance, versioning, and inventory across programs without slowing placement or endorsements.

Built for regulated insurance at production speed

Faster to value

First production wins in weeks – up to 90% faster than code‑plus‑consultant stacks.

Audit‑ready

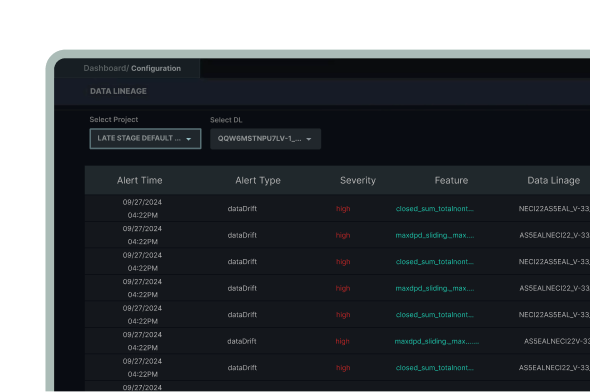

Auto‑documentation, lineage, explainability, approvals, drift/bias alerts, and examiner‑ready packs by design.

Connectors

Any‑framework deployment with versioning, blue/green, and safe rollbacks when policy shifts hit.

Where value lands across the policy lifecycle

Claims Intake & Triage

Prioritize severity, route accurately, and shorten cycle time with explainable triage that stands up to review and recovery teams.

Fraud & SIU

Detect more with fewer false positives; link entities, preserve case trails, and escalate confidently with portfolio‑level model inventory.

Underwriting & Risk Selection

Score submissions, align to appetite, and document binds with maker–checker approvals and explainability baked in.

Retention & Lapse Prevention

Predict lapse risk, tailor pricing and outreach, and keep policies active with governed personalization and drift control.

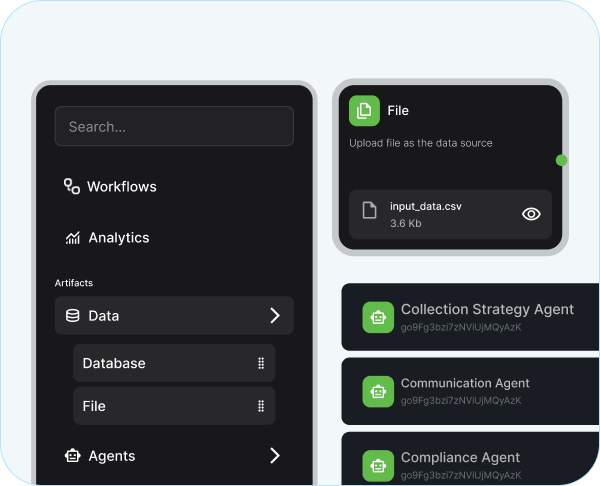

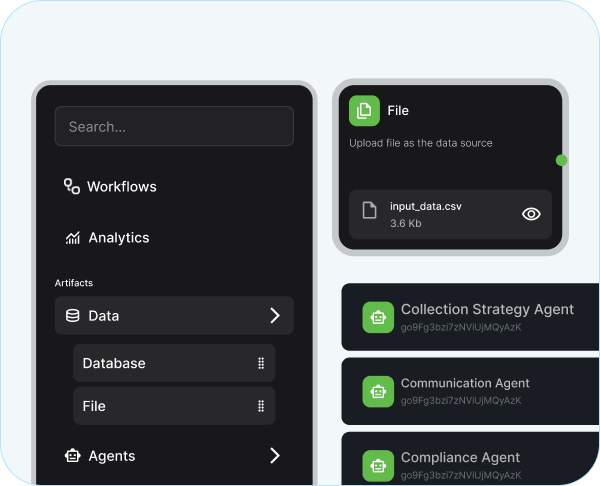

The iTuring Platform

One governed backbone across data, modeling, deployment, risk, and governance for insurers finance.

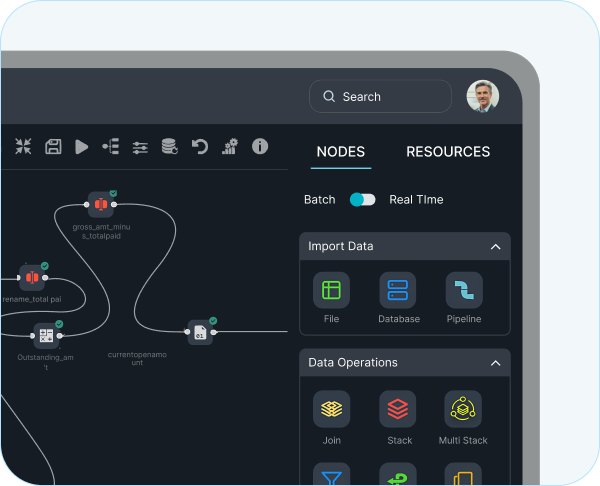

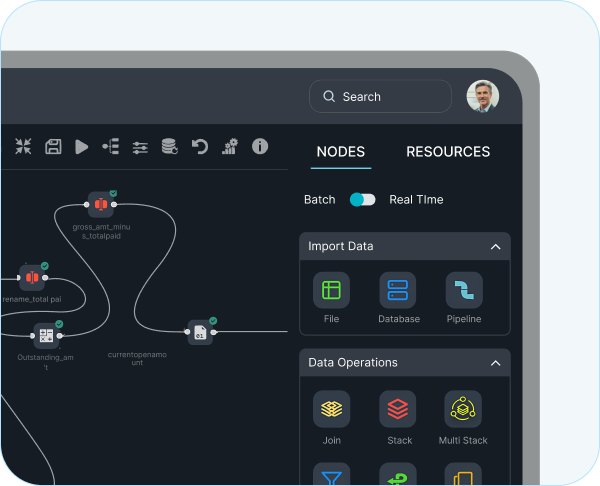

Data Accelerator

25,000+ insurance‑ready features with lineage to turn months of data work into hours – no code required.

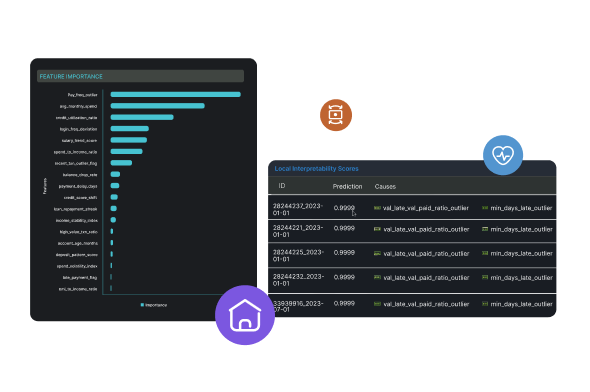

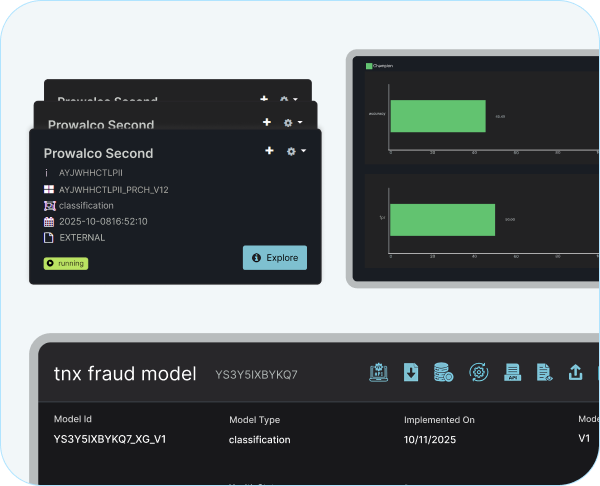

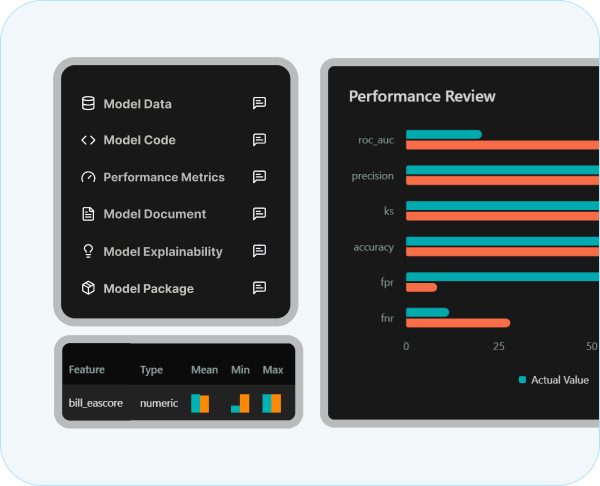

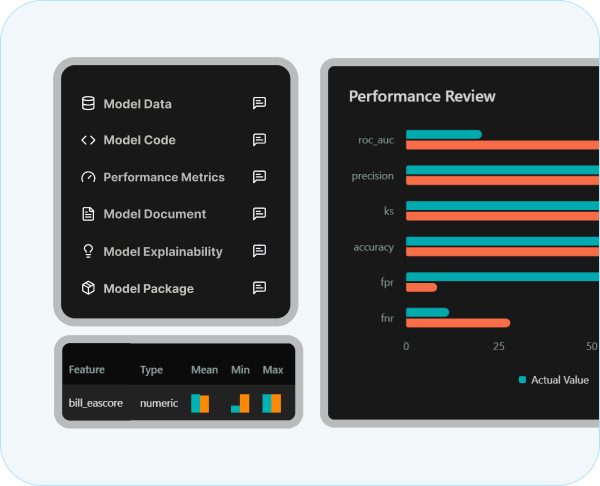

Auto ML

4,000 agents compete to produce champion models with instant explainability and auto‑documentation.

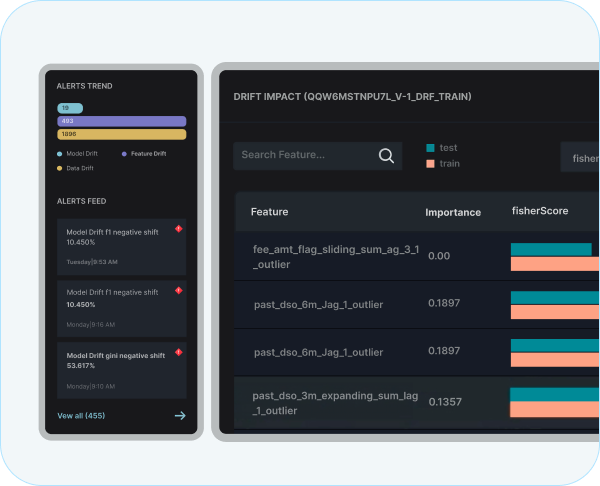

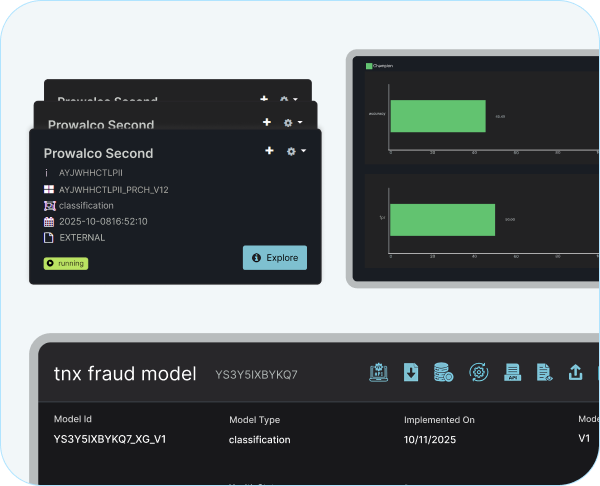

Model Ops

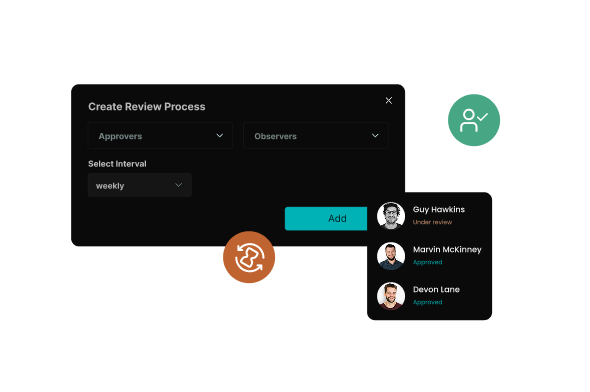

Deploy iTuring, Python, R, or Spark with maker–checker, version control, blue/green, and rollback on tap.

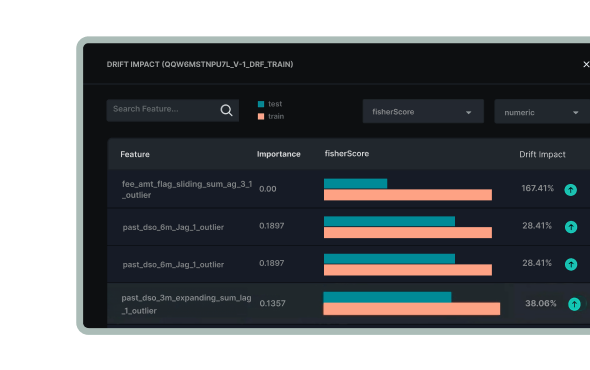

Model Risk

Model Governance

Central inventory, immutable trails, approvals, and examiner‑ready evidence across iTuring and third‑party models.

Premium Collections - fewer arrears, lower OPEX, clearer audit

Segment by risk and responsiveness, adapt messages and channels in real time, and keep every promise‑to‑pay traceable from strategy to settlement.

Reduce early‐stage arrears with risk tuned next best actions.

Improve right party contact and promise to pay fulfillment.

Preserve end-to-end governance in billing and dunning.

Governance that passes the read‑through test

What reviewers receive

Immutable lineage, per‑decision explanations, maker–checker trails, approval history, model inventory, and exportable evidence packs.

What leaders gain

Policy‑driven alerts for drift and bias; push‑button retrain or rollback to keep performance and compliance aligned.

Committee‑ready documentation

Portfolio‑level visibility across models

Governance policy aligned change control

From data to defended decisions

Data in

Connect policy, claims, billing, CRM, lakes, and streams; reuse features with lineage across lines and products.

Build/validate

AutoAI runs champion–challenger, logs explainability and documentation per step, and prepares approval packs.

Deploy/monitor

Any framework to production with blue/green, versioning, 60+ live‑risk checks, and portfolio dashboards for MRM.

Frequently Asked Questions

Do same governance controls apply across P&C, L&A, Health, and Reinsurance?

Yes – lineage, explanations, approvals, and evidence packs are consistent across lines, with deployment scaled to each environment.

How fast to realize or deliver first value?

First value is typically within two weeks, with documented outcomes visible by 30–60 days depending on scope and data access.

Can we govern existing Python/Spark/SAS models?

Yes – govern iTuring and non‑iTuring models with the same approvals, inventory, and evidence exports.

What audit evidence is produced?

Step‑level documentation, per‑decision explanations, approvals, version history, lineage, and exportable exam packs.