Fraud and Financial Crime

Catch hidden fraud. Prove every decision.

92% accuracy with fewer false positives, complete audit trails, and 30‑minute investigations

iTuring.ai automates the entire fraud detection process from raw data to production deployment. With 50,000 ready financial features and complete lineage so you catch more fraud without blocking good customers.

18

banks and insurers live

140

Use Cases

What changes when fraud AI works properly

92%

fraud detection accuracy

1.9x

reduction in false positives

30Mins

to close cases instead of 3 weeks

Stop losing good customers to catch bad ones

Traditional fraud systems force impossible trade‑offs between catching fraud and approving legitimate transactions. iTuring's zero‑code platform builds explainable models that improve both accuracy and customer experience while delivering complete audit documentation.

From raw data to production fraud models in weeks

Connect

Upload fraud data from any source. Data Accelerator connects to your systems and lets you select from 50,000 pre-built fraud intelligence features with complete lineage tracking.

Compete

AutoML tests multiple algorithms with intelligent hyperparameter optimization to find the champion model, with built-in explainability and automated documentation.

Deploy

One-click deployment to production with 60+ live risk checks, continuous monitoring, and instant regulatory evidence generation.

Every fraud decision comes exam‑ready

Immutable audit trails for every fraud alert and decision with full explainability in plain business English.

Maker‑checker workflows with time‑stamped approval history and automated documentation.

Downloadable exam packs that include model lineage, feature importance, and decision rationale.

Three fraud patterns

we solve

Account opening fraud

Detect synthetic identities and account takeovers using behavioral patterns and device fingerprinting.

Transaction fraud

Real‑time scoring that catches suspicious patterns while keeping legitimate transactions flowing.

Identity verification

Link customer data across channels to prevent fraud without creating friction for genuine customers.

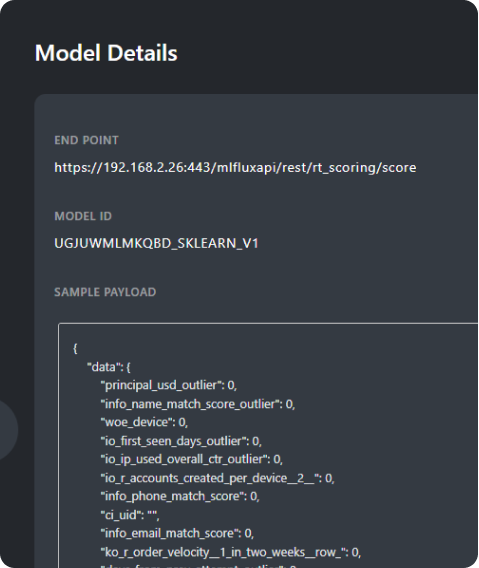

Plugs into your existing fraud infrastructure

Connect to core banking, payment processors, card authorization systems, and KYC platforms; deploy as API endpoints or embed directly into existing workflows.

Real‑time scoring APIs with sub‑second response times

Batch processing for historical fraud analysis

Seamless integration with fraud case management systems

Built for fraud, risk, and compliance teams

Fraud Manager

Higher win rates at constant risk.

Risk Officer

Complete audit trails and full decision transparency

Operations Team

Reduced manual review workload and faster case resolution

Compliance

Regulator‑ready documentation and model governance

Get started with iTuring

Frequently Asked Questions

How accurate is iTuring's fraud detection?

Our supervised learning models achieve up to 97% accuracy with only 3% false positives in production environments.

How quickly can fraud models be deployed?

From data upload to production deployment typically takes 2‑4 weeks vs 3‑6 months with traditional development.

What audit documentation is provided?

Complete model lineage, feature explanations, decision rationale, and one‑click regulatory exam packs are automatically generated.

Can it integrate with existing fraud systems?

Yes – iTuring connects to all major fraud management platforms through APIs and pre‑built connectors.