Payment & Fintech

Fintech AI that approves faster, prevents fraud, and scales with control

Governed intelligence for origination, payments risk, collections, and growth – live in weeks

Add explainability, lineage, approvals and live risk checks into every decision so as to improve conversion losses while ensuring a clean, defensible regulator-compliant trail.

18

banks and insurers live

140

use cases

Built from the ground up for your business

Personal Lending Platforms

Approve good borrowers in minutes with transparent explanations, while reducing false declines that limit growth.

Business Lending Fintechs

Score thin‑file SMBs using alternative data, document risk decisions for committees, and keep loss ratios stable.

Mortgage

Lenders

Flag verifications and risks early in workflow; audit ready decisions that withstand underwriting reviews.

Alternative Credit Providers (incl. BNPL)

Real‑time risk assessment, lifecycle collections, and chargeback prevention with full lineage across offers, spending, and repayments.

Speed and Governance Built-In

Built for production speed without governance gaps

Faster to value

First production wins in weeks – up to 90% faster than code‑plus‑consultant stacks.

Audit‑ready

Auto‑documentation, lineage, explainability, approvals, drift/bias alerts, and examiner‑ready packs.

Connectors

Open by default – any‑framework deployment with versioning, blue/green, and safe rollbacks.

Acquisition, lifetime value, and loss

Credit Origination and Risk

Approve more qualified customers with same‑day decisions and committee‑ready documentation – thin files welcome.

Fraud and Payments Risk

Detect account opening and transaction abuse with fewer false positives and a complete decision trail.

Collections and Recovery

Lift RPC/PTP and shrink cost‑per‑contact with risk‑segmented, agentic outreach tuned to willingness and ability to pay.

Customer Growth and lifetime value

Predict response and pricing sensitivity

to drive profitable upsell, cross‑sell, and retention – without black‑box risk.

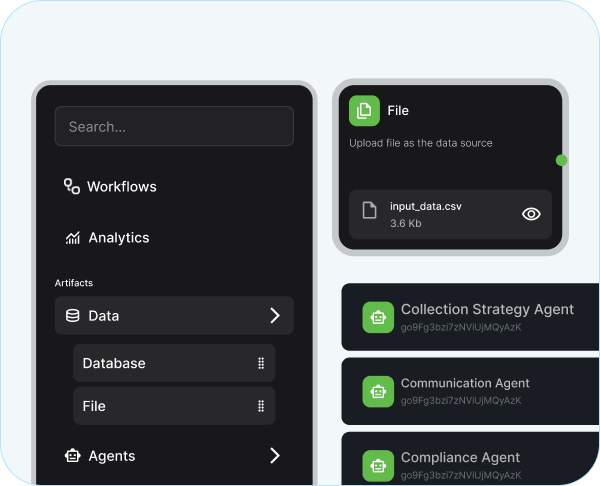

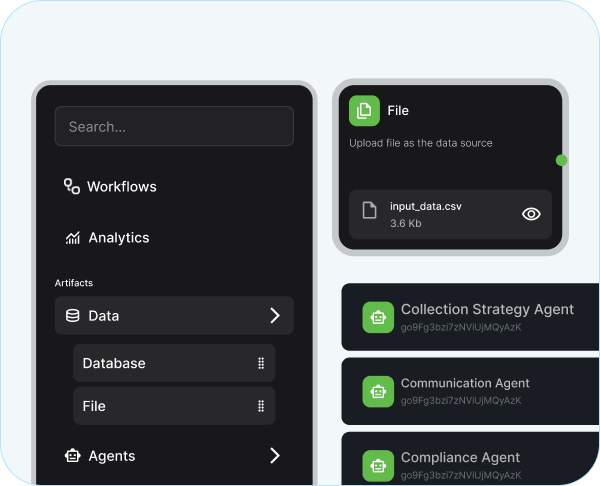

The iTuring Platform

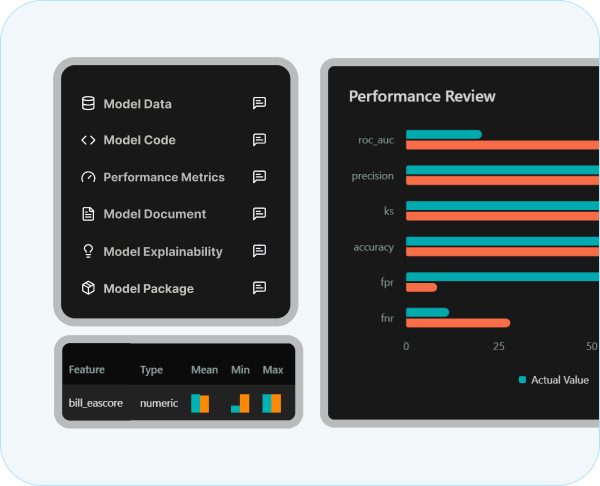

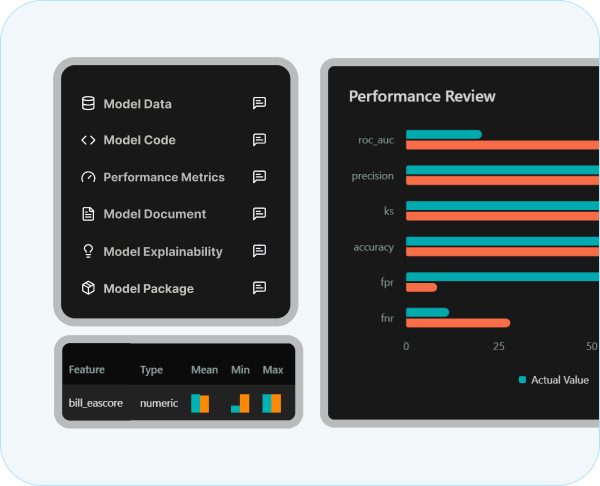

One governed backbone across data, modeling, deployment, risk, and governance for for fintech scale

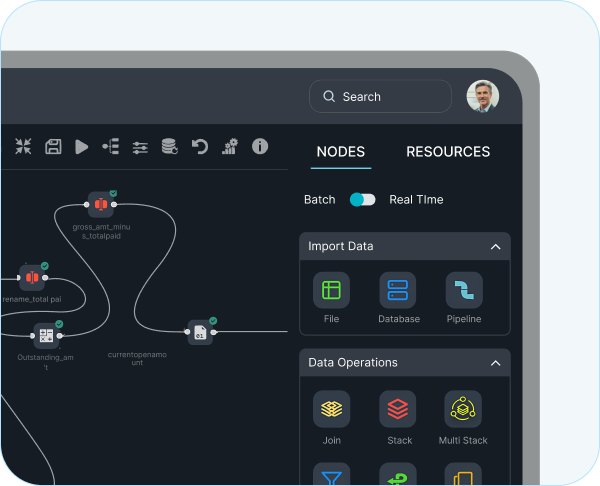

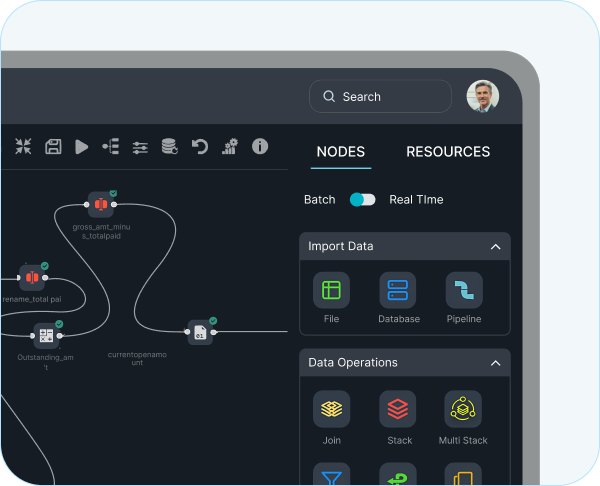

Data Accelerator

25,000+ financial and behavioral features with lineage to turn months of data work into hours – no code required.

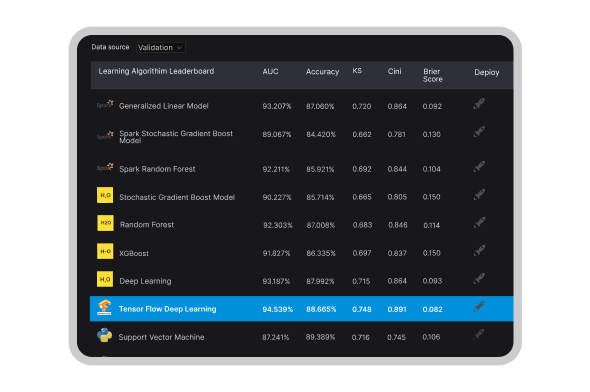

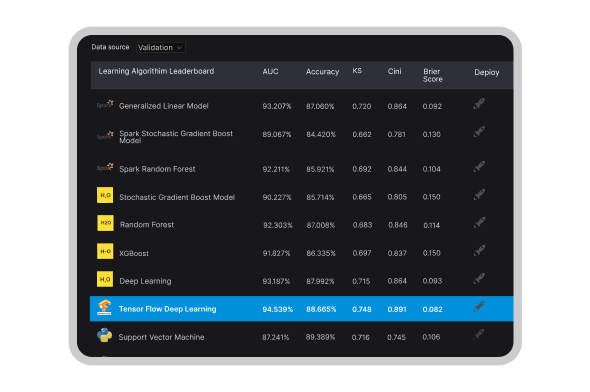

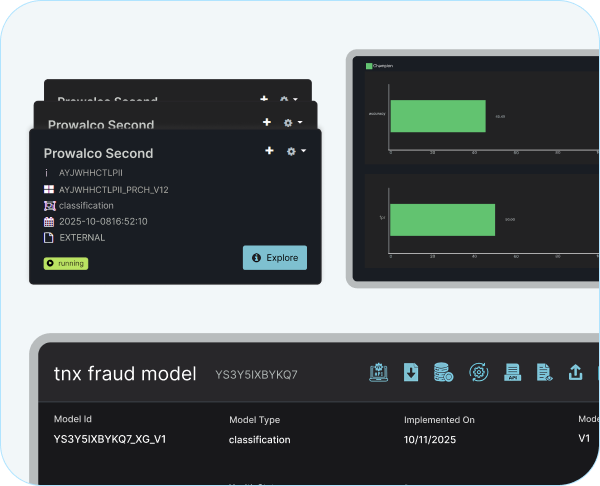

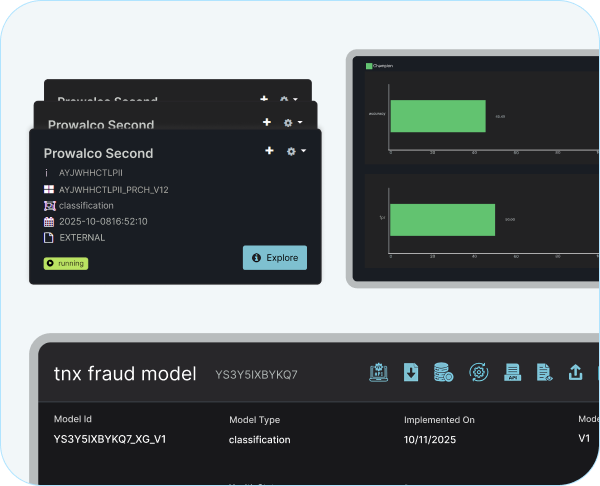

Auto ML

4,000 competing agents produce champions with instant explainability and automated documentation per step

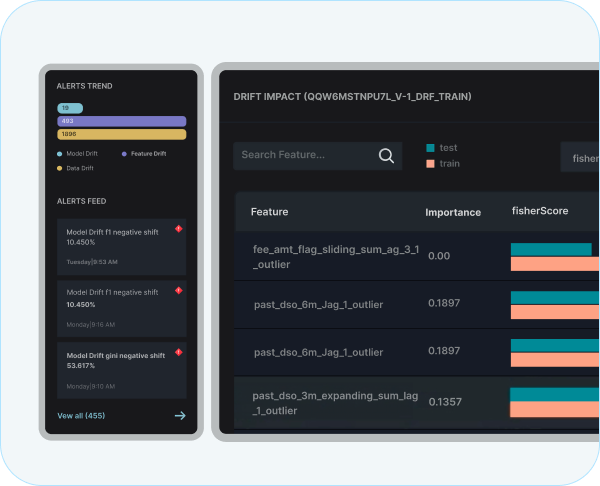

Model Ops

Deploy any framework (Python, R, Spark, SAS) with maker–checker, versioning, and one‑click rollback.

Model Risk

Model Governance

Central inventory, immutable trails, approvals, and examiner‑ready evidence across iTuring and third‑party models.

Digital Collections - recover more, spend less, and keep customers

Segment by risk and responsiveness, adapt content and channel in real time, and keep every promise‑to‑pay traceable from strategy to settlement.

Lift right‑party contact and promise fulfillment

Reduce cost‑per‑contact with agentic outreach

Preserve end‑to‑end governance across repayments

Governance that scales with growth and scrutiny

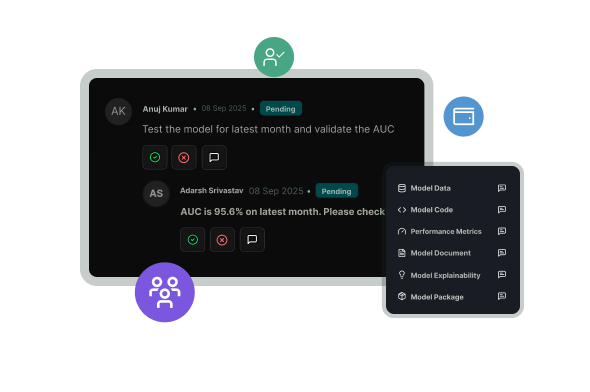

What reviewers receive

Immutable lineage, per‑decision explanations, maker–checker trails, approval history, model inventory, and exportable evidence packs.

What leaders gain

Policy‑driven alerts for drift and bias; push‑button retrain or rollback to keep performance and compliance aligned.

Committee‑ready documentation

Portfolio‑level visibility across models

Governance policy aligned change control

Our Complete Workflow

From data to defended decisions

Data in

Connect apps, payments, bureaus, alt‑data, lakes, and streams; reuse features with lineage across funnels and products.

Build/validate

AutoAI runs champion–challenger, logs explainability and documentation per step, and prepares approval packs.

Deploy/monitor

Any framework to production with blue/green, versioning, 60+ live‑risk checks, and portfolio dashboards for model risk.

Frequently Asked Questions

Can we govern models built outside iTuring?

Yes – govern iTuring and non‑iTuring models with the same approvals, inventory, and evidence exports.

How fast to first value?

First value is typically within two weeks, with documented outcomes visible by 30–60 days depending on scope and data access.

Do you support real‑time APIs at decision time?

Yes – low‑latency scoring and decisioning with versioned endpoints, blue/green, and rollback.

What audit evidence is produced?

Step‑level documentation, per‑decision explanations, approvals, version history, lineage, and exportable exam packs.