Banks & Credit Unions

Ship financial AI that wins in production and stands up in audit

Build financial AI that wins in production – and stands up in audit

Same‑day underwriting, agentic collections, lower false positives, and true Net New Money growth with explainability, lineage, approvals, and live risk checks built in.

18

banks and insurers live

140

use cases

Built from the ground-up with your business in mind

National

Standardize governance at scale, centralize model inventory and compress approval cycles with maker–checker and auto‑documentation.

Credit

Unions

Grow member balances through true Net New Money, reduce false positives, and preserve decision traceability end‑to‑end.

Community

Banks

Lift RPC Rate and Propensity/Promise to Pay with agentic outreach and deploy transparent underwriting decisions that are easy to explain.

Super Regional and Regional Banks

Move governed models from pilot to production in weeks – without expanding engineering teams.

Why iTuring delivers results

Faster to value

Projects live in weeks – up to 90% faster than code‑plus‑consultant stacks.

Audit‑ready

Auto‑documentation, lineage, explainability, approvals, drift/bias alerts, and exam‑ready packs.

Connectors

Any‑framework deployment with versioning, blue/green, and rollbacks.

Use cases that matter to your P&L

Credit Underwriting

Increase approvals at the same risk and move to same‑day decisions with committee‑ready documentation.

Fraud and AML

Detect more with fewer false positives; keep lineage and case trails intact across channels and models.

Deposit Growth (NNM)

Target genuine new capital with NNM propensity and price‑elasticity models validated on large cohorts.

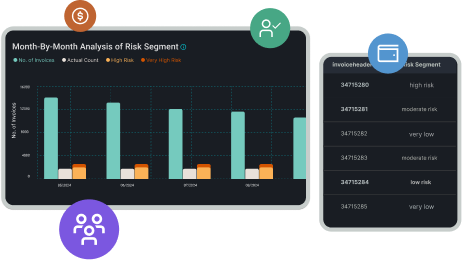

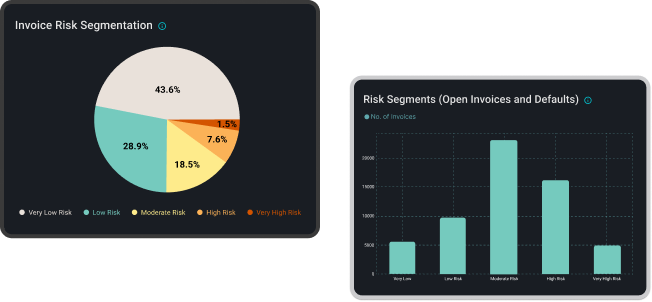

Collections Optimization

Raise RPC/PTP and reduce cost‑per‑contact with risk‑segmented, agentic outreach and next‑best actions.

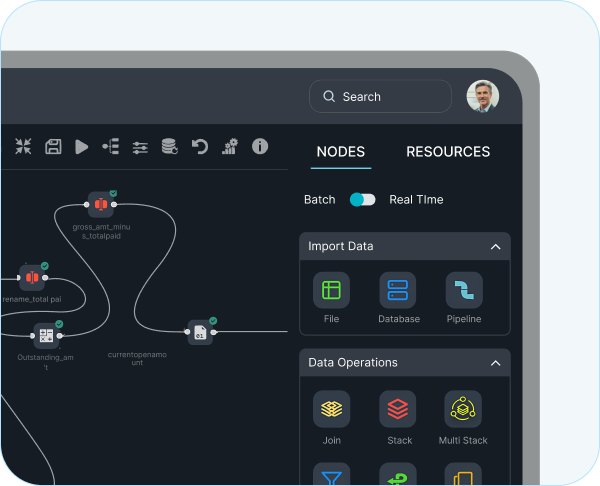

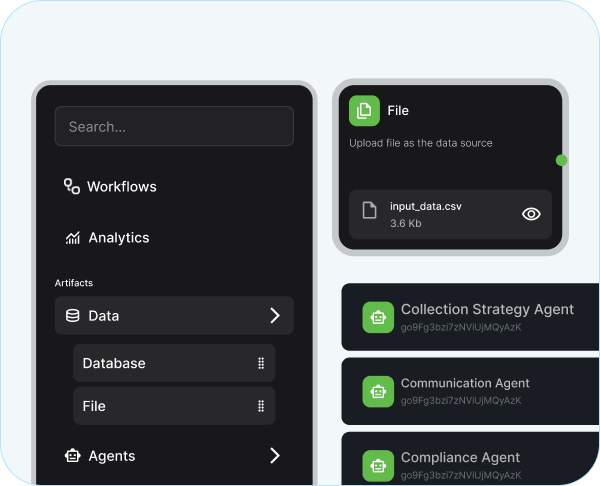

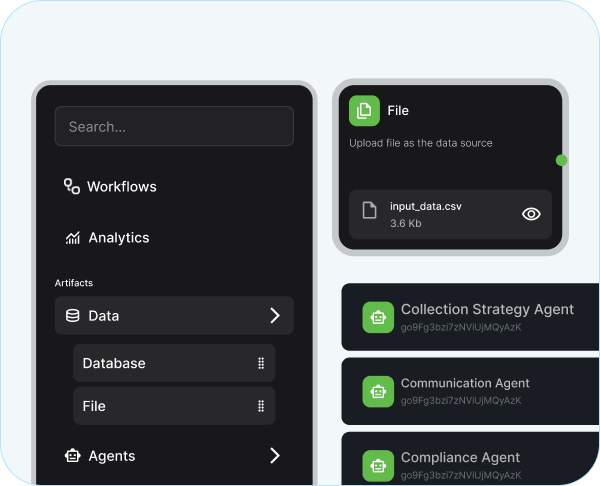

The iTuring Platform

One governed backbone across data, modeling, deployment, risk, and governance for regulated finance.

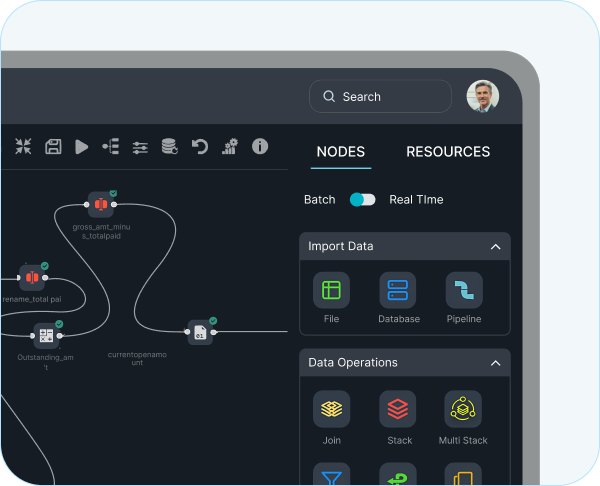

Data Accelerator

25,000+ insurance‑ready features with lineage to turn months of data work into hours – no code required.

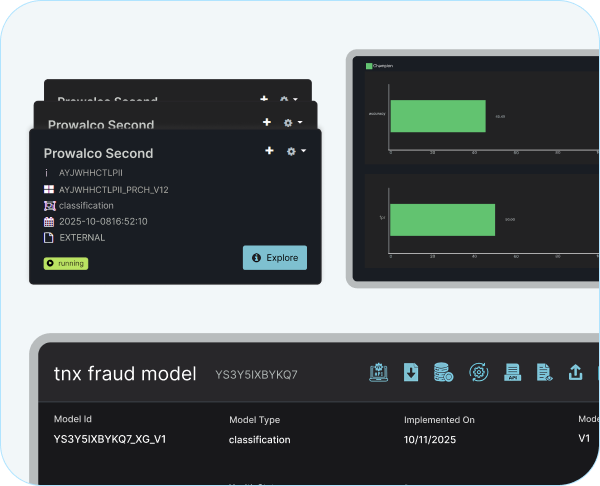

Auto ML

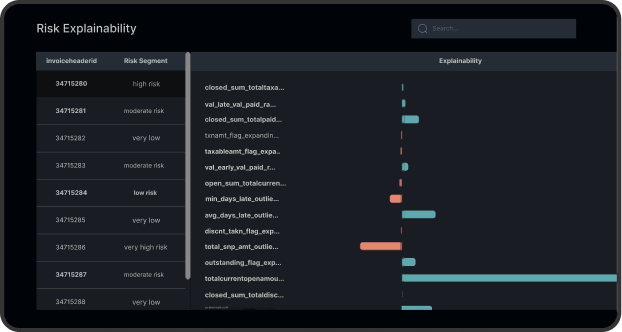

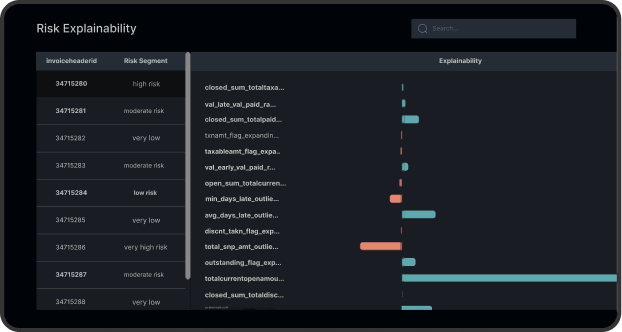

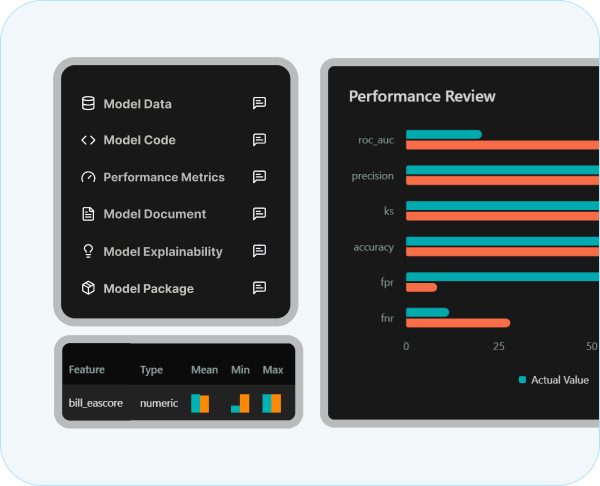

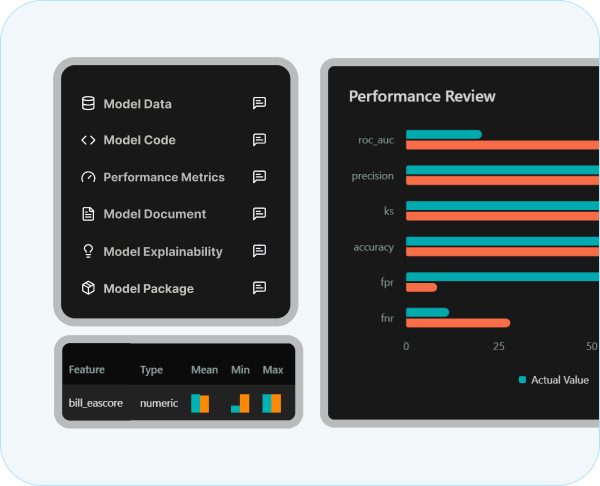

4,000 agents compete to produce champion models with instant explainability and auto‑documentation.

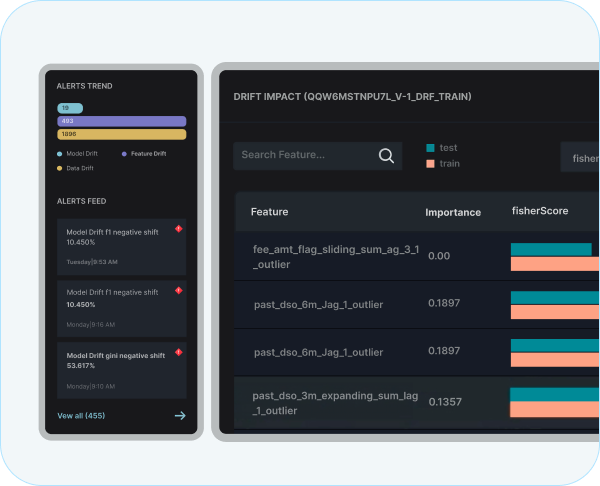

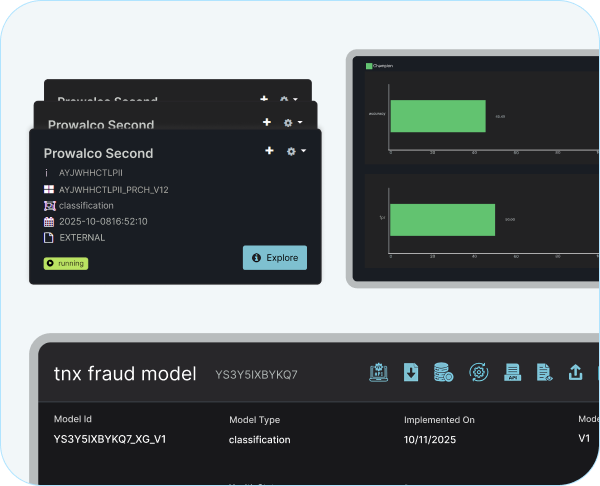

Model Ops

Deploy any framework (Python, R, Spark, SAS) with maker–checker, versioning, and one‑click rollback.

Model Risk

Model Governance

Central inventory, immutable trails, approvals, and examiner‑ready evidence across iTuring and third‑party models.

iTuring Collections - agentic outreach that lifts recoveries

Risk‑segmented next‑best actions adapt messages, channels, and offers to increase RPC/PTP and lower OPEX. Campaigns self‑improve via uplift signals and drift checks while governance and audit remain intact.

Always audit‑ready

What auditors receive

Immutable lineage, per‑decision explanations, maker–checker trails, approval history, model inventory, and evidence export in standardized packs.

What leaders gain

Speed without surprises - policy‑driven alerts for drift, bias, and thresholds that trigger retrain or rollback.

SR 11‑7‑friendly documentation

Change control fit for committees

Portfolio‐level view across iTuring and third‐party models

Data To Deployed Models

How it works

Data in

Connect cores, LOS, CRMs, lakes, and streams; feature store lineage enables safe reuse across teams.

Build/validate

Auto ML runs champion–challenger, logs explainability and documentation per step, and prepares approval packs.

Deploy/monitor

Any framework to production with blue/green, versioning, 60+ live‑risk checks, and portfolio dashboards for MRM.

Frequently Asked Questions

Do community banks and credit unions get the same governance controls as nationals?

Yes – identical lineage, explainability, approvals, and documentation with deployment scaled to each environment.

How fast to realize or deliver first value?

First value often within two weeks, with documented outcomes visible in 30–60 days depending on data access and scope.

Can existing Python/Spark/SAS models be governed?

Yes – govern iTuring and non‑iTuring models with the same approvals, inventory, and evidence exports.

What audit evidence is produced?

Step‑level documentation, per‑decision explanations, approvals, version history, lineage, and exportable exam packs.