Growth & Retention

Grow balances. Keep loyal customers. Defend today’s book.

Predictive and agentic AI that accelerates Net New Money, multiplies cross-sell, and reduces churn

iTuring AI growth and retention identifies the right segment for every product, targets messaging and price at a market of one, and provides evidence-backed forecasts to win new capital, defend share, and keep policyholders active.

18

banks and insurers live

140

Use Cases

Measurable gains in deposits, balances, lifetime value

$45M+

new capital delivered in 90 days

1.9x

reduction in collection operations costs

29%

reduction in churn and lapse

Growth fails when targets are wrong, churn is invisible until too late.

Broad campaigns waste spend on fence-sitters and miss high potential customers. Retention programs are reactive, not predictive. iTuring uses predictive intelligence and autonomous outreach to produce documented growth and measurable retention gains

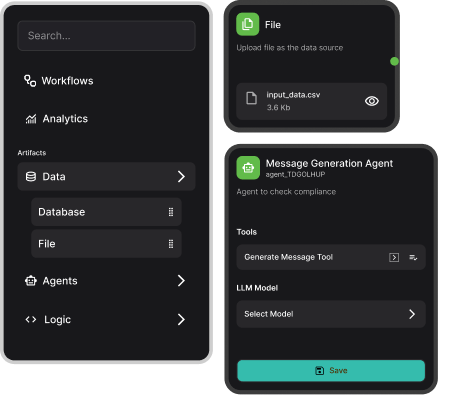

From scattered data to proven results in three steps

Pinpoint

Data Accelerator identifies high-value segments using 25,000 pre-built features - deposits, cross-sell potential, and churn risk - in real time, not retrospectively.

Predict

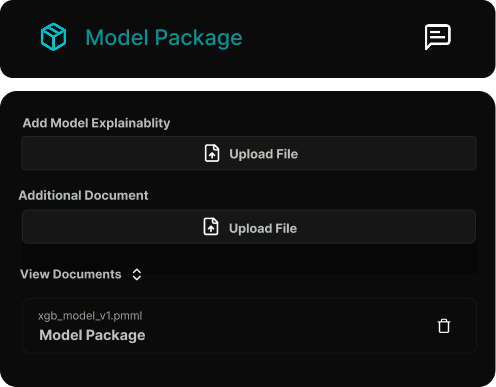

AutoML trains champion models using competing algorithms and hyperparameter optimization to forecast deposit growth, product uptake, and retention. Deploy with A/B testing and complete explainability.

Personalize

AI generates customer-specific offers and timing. Platform captures every outcome - uplift, retention, loss prevention - with audit-ready documentation for examiners.

Documented proof of growth and risk controls

Immutable records of every model, campaign, and result

Full lineage for data, features, and models

Regulatory evidence packs for NNM, upsell, and retention campaigns

How leading institutions grow faster and lose less

NNM Propensity

Precision targeting for campaigns generates $45M+ new deposits in 90 days with clear OOT validation.

Cross-Sell Uplift

Next-best product and pricing lift sales up to1.9x compared to standard campaigns.

Churn Defense

Lapse reduction programs for insurance and banking with agentic outreach and 29% fewer losses.

Growth intelligence that fits anywhere

Integrates with core banking, product, and CRM platforms for banks, insurers, fintech; unlocks cross-sell and upsell for digital, branch, and agent.

Plug into campaign and CRM systems.

Low-latency scoring APIs for channels and sales.

Full uplift and retention dashboards for business and committees.

Built for marketing, product, and loyalty teams

Deposit/Balance Marketing

target, lift, and log new funds

CX/Product

double conversion and remove siloes via AI

Retention/Churn

predict and prevent losses before they occur

Risk/Gov

full audit evidence on all growth and retention motions

Grow with AI that proves its impact

Frequently Asked Questions

How is NNM uplift proven and tracked?

Documented cohort validation, model explainability, and OOT uplift; every program comes with exam-ready proof packs.

What channels does agentic AI cover?

All digital, branch, and agent channels for new funds, cross-sell, and retention outreach.Up to 60% reduction in collection costs and manual agent time, with 10x ROI delivered in 4 months.

What does it take to get live?

Integrate via our accelerator: most teams see uplift and full dashboards inside four weeks.

How is compliance maintained?

Full auditing lineage, model governance, and regulatory evidence are part of every campaign and offer.